How our SaaS platform is helping bridge the gap between market intelligence and market share.

Energy production is changing. How can we change with it?

We are currently seeing a huge shift in the energy industry. As companies adapt and assess the future shape of their industry, they need something more…

…more data, more details, more context.

The world’s certainly not short of data – there’s an ocean of it out there. But when we formed Archer Knight four years ago, it was because we felt the market analysis products available to operators, service companies and contractors required a greater depth of granular detail to take them over the ‘last mile’ in securing more projects.

Reinventing market intelligence

This was the driver behind launching Flowline, our software-as-a-service (SaaS) platform, earlier this year.

Our platform has revolutionised how we deliver subsea market intelligence. It applies our bottom-up granular analysis to give a real-time view of the subsea market. We’ve created a platform which acts as your very own ‘digital employee', sending customisable data directly to our clients, returning valuable time back to their schedules and increasing visibility.

Flowline is user-friendly, giving clients control and the ability to access the information they need. Not only that, but with no restrictive licensing arrangements, it’s available to everyone across the business.

How Flowline is providing solutions

Since launching Flowline we’ve been able to put our theories to the test. Here are three scenarios where our platform helps give the data and the detail which is helping clients make better decisions:

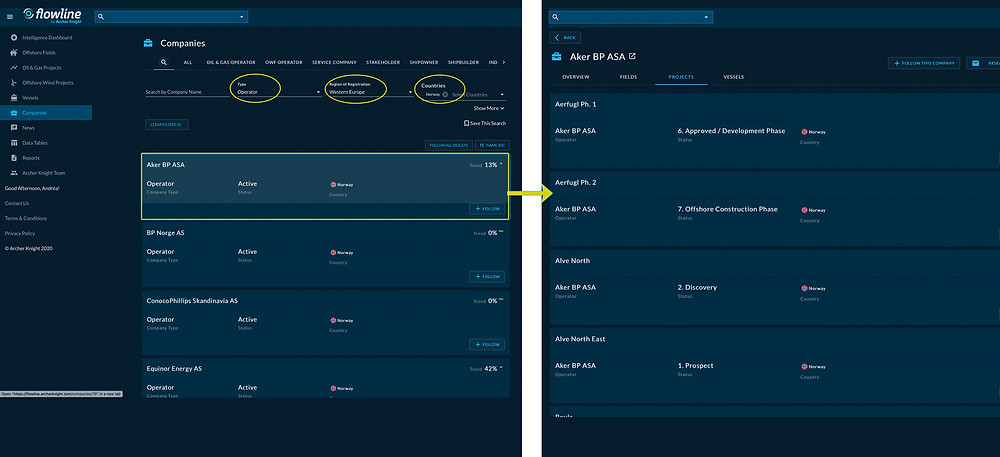

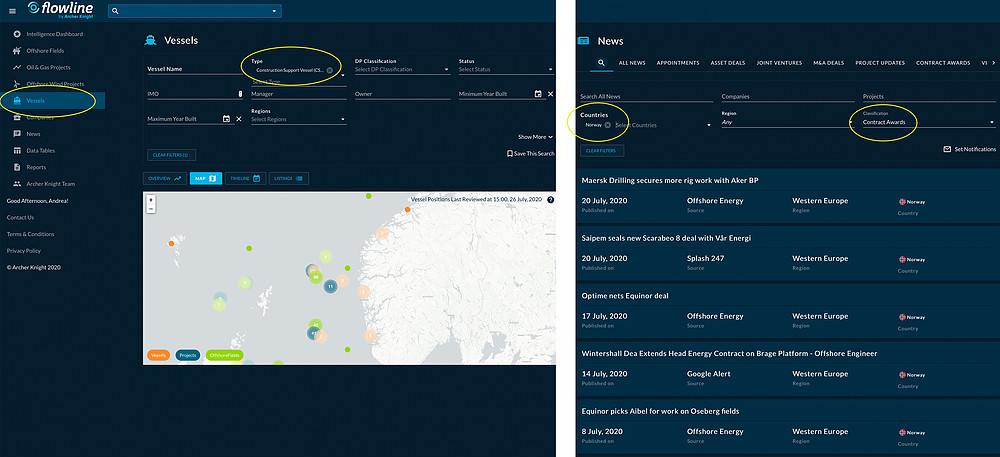

1) Deeper understanding of specific regions

Through each progressive downturn, companies working in the subsea industry (and the wider oil & gas industry), have had to become leaner and meaner. Every potential opportunity is put under greater scrutiny to assess whether it is commercially viable to pursue it. This means gathering information tailored specifically to your needs.

For example, we’ve had contact from companies specialising in providing diving support vessels or remotely operated vessels, wanting to get a more accurate picture of their market.

With a full market review through Flowline, they receive up-to-the-minute detailed information on potential clients in specific regions, including fields and projects, what the best contact strategies are and any historical evidence of preferred contractors. Flowline also includes comprehensive coverage of competitors operating in the same market, such as lists of owned and chartered principal assets and equipment associated with offshore services, and whether these assets are currently active.

This information has allowed Flowline’s users to make more confident predictions of whether a business opportunity makes economic sense, or if their resources should be deployed elsewhere.

Read more from John Black on relationships and resilience in the supply chain

2) Support for new entrants to the market – or those wanting to diversify

Diversification is the current watchword for much of the industry – and it’s likely to be like this for some time to come. Companies know they have to explore different markets as the industry changes around them.

We’ve had contact from new market entrants, as well as experienced operators needing to pivot their operations to a different subsector. They need detailed information on the current market size, insight into what future supply and demand looks like and analysis on the other trends and developments which will have an impact on their ability to grow.

For example, we’re able to provide companies moving into floating offshore production with data on the potential numbers of floating assets required in specific regions; the projects, operators and even supply-chain requirements which will be involved; and who the key decision makers are.

Clients want visibility on more than oil & gas too. The growing renewables market is currently proving to be an attractive area for diversification, but many companies working in oil & gas lack the necessary detailed insight, such as market size and where the best opportunities lie. Unlike many market intelligence platforms, Flowline covers wind alongside oil & gas.

3) Greater insight into what your competitors are doing

Companies don’t want to merely compete for tenders, they need to know they can win the business. By assessing the market and their competitors they can put themselves into a better position to successfully bid for contracts.

With Flowline, we’re able to provide our clients with the context they need on essential areas including: detailing the regional combined fleet activity and availability, identifying patterns of companies for preferred clients or contractors, analysing new contract awards, and pinpointing areas where there could be a commercial upside, or where there may be saturation and a reduced chance of winning business.

Read more from Ross Macdonald on the role companies play in our assessment of market intelligence

Want to find out more?

What all these solutions have in common is the benefit of granular insight, analysis from the ground floor up which can give companies the context they need, putting them in a better position to win more business.

Find out more about Flowline here or contact us at flowline@archerknight.com to book in a demonstration.

David Sheret is Executive Director and Co-Founder of Archer Knight. Contact him at dsh@archerknight.com

4 min read

How to manage energy transition in oil & gas

Done right, the move towards carbon neutral offers companies new and exciting opportunities. The industry is embracing the energy transition...

1 min read

Archer Knight expands intelligence platform to embrace the offshore wind revolution

Market intelligence software now includes global floating and fixed projects. The energy industry is changing at a rapid pace, and at Archer Knight,...

2 min read

Experts give their views on future of floating energy

Inaugural event helps industry leaders understand the challenges ahead Technological innovation. Learning from experience. Collaboration....