1 min read

Subsea companies need to be "asset ready and pandemic proof"

![]() Archer Knight

:

December 8, 2020

Archer Knight

:

December 8, 2020

David Sheret highlights the positive market opportunities at OSJ Asia.

Subsea vessel owners need to focus on their core strengths and where they provide value to capitalise on opportunities ahead.

Speaking at OSJ Asia, David Sheret, Archer Knight executive director and co-founder, said there are reasons for subsea vessel owners and managers to be optimistic after a year severely impacted by the global pandemic.

But he said businesses need to lay the groundwork to take advantage of positive signs on the horizon.

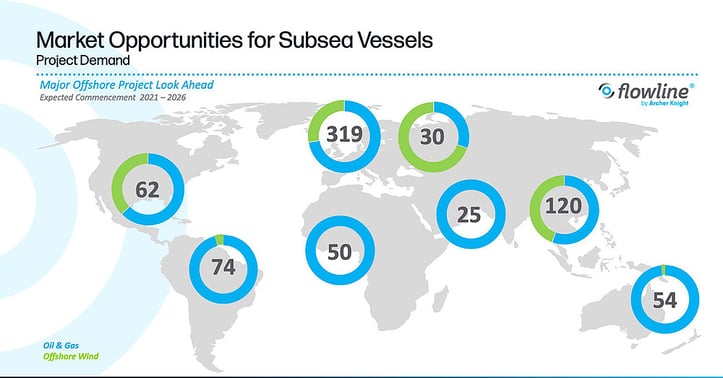

He told the annual conference, hosted online this year due to coronavirus travel restrictions, that market opportunities were emerging over the next five years, with offshore wind becoming more important alongside oil and gas.

More than 700 projects are due to start by 2026*, in oil and gas and offshore wind. Much of the focus is on CAPEX and DEVEX (development expenditure) projects, such as construction, rather than decommissioning, which Mr Sheret said was a positive for the industry.

But to succeed, companies need to ensure they are “asset ready and pandemic proof” as well as making sure their businesses are set up for a new environment where lower oil prices are the norm. Adaptability to alternative subsea engineering markets will be essential.

But to succeed, companies need to ensure they are “asset ready and pandemic proof” as well as making sure their businesses are set up for a new environment where lower oil prices are the norm. Adaptability to alternative subsea engineering markets will be essential.

He set out several areas where companies need to focus, including ensuring they are ‘asset ready’ with the right vessels focused on the right areas.

In particular, he stressed “you need to be pandemic proof.” After the impact of COVID-19 in 2020 on global markets, he said it was important for companies to ensure they were set up to cope with similar events in the future.

“If another pandemic happens. How are you going to manage that process and how are you going to protect your client’s interests?”

Other areas of focus for companies include ensuring the offering is not too wide-ranging and investing in new build vessels that are fit for purpose.

He highlighted ‘next-generation’ assets that have adapted to more modern markets, such as the Seven Vega which launched in November 2020. The vessel advances capabilities in terms of the features it can carry out (such as laying electrically heated heat-traced flowline systems). He said: “These are vessels which show companies that have looked at the future of where the market will be – and acted accordingly.”

David Sheret spoke at OSJ Asia on Wednesday 2 December. Get in touch here for your complimentary copy of the presentation.

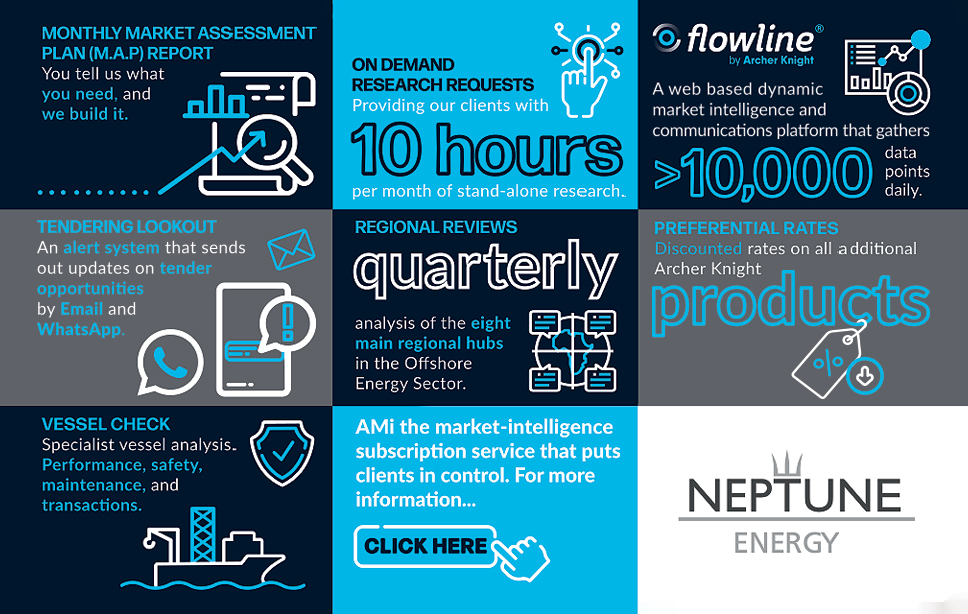

Archer Knight can help provide you with granular market intelligence and identify the best opportunities. Discover more here.

*Source: Flowline® by Archer Knight

1 min read

Archer Knight wins major market intelligence contract with Neptune Energy

Leading independent E&P company to use the Alliance Market Intelligence (AMi) service for its employees worldwide. Archer Knight has hailed a...

2 min read

4 ways to more powerful market intelligence: Part 3

Change happens fast in upstream oil & gas. Ross Macdonald looks at the four core areas we focus on to make sense of the volatility and...

1 min read

Global energy movers and shakers: Africa

Looking ahead to 2021 in our new offshore energy profiles Africa is home to some of the world’s most notable oil & gas producing countries, as well...