Company opens up to investors as it positions itself for accelerated growth.

Archer Knight are conducting a cash-for-equity raise as it prepares for future growth.

After the successful launch of its software-as-a-service platform Flowline earlier this year, the company has confirmed it is seeking to implement an accelerated liquidity event (ALE).

Flowline is already providing companies globally with granular market intelligence on the energy industry. The additional investment will help expand Archer Knight’s marketing effort as it drives brand awareness, builds its sales team to engage and convert opportunities, and develop the platform’s support software.

In 2019, Archer Knight successfully raised £500,000 from 21 ‘high-net-worth’ investors, many of whom are following their initial investment. Now the team is looking externally and opening up the equity raise further.

Announcing the raise on Friday, David Sheret, Co-Founder and Executive Director, said:

‘We've benefited significantly from having established industry experts as shareholders. People based in the US, Norway, Dubai, Spain and the UK, all with different but compatible capabilities, vertically and horizontally. However, we want to widen our company's ecosystem further.

‘We're opening up part of our second equity raise to people from around the world who feel they can add value to the Archer Knight team.

‘It doesn't matter what you do or where you're based. If you've always wanted to own part of a company and you feel you would add value to our collective shareholders, we want to hear from you. And you don’t have to have thousands to get involved.’

For more information get in touch with David Sheret @ dsh@archerknight.com

The Company will be supported through the raise by Infinity Partnership and Pinsent Masons.

Disclaimer: Investing in Archer Knight (Holdings) Limited (AKHL) carries the same risk as any investment in a private limited company. Share investment characteristically brings significant risk. AKHL strongly advice that all investors think carefully about the investment and carry out proper due diligence in parallel with consulting their own, independent, professional financial and legal advisors.

Flowline Information video launched

Flowline Information Video Click on the image above to watch an information video on our SaaS platform, Flowline.

1 min read

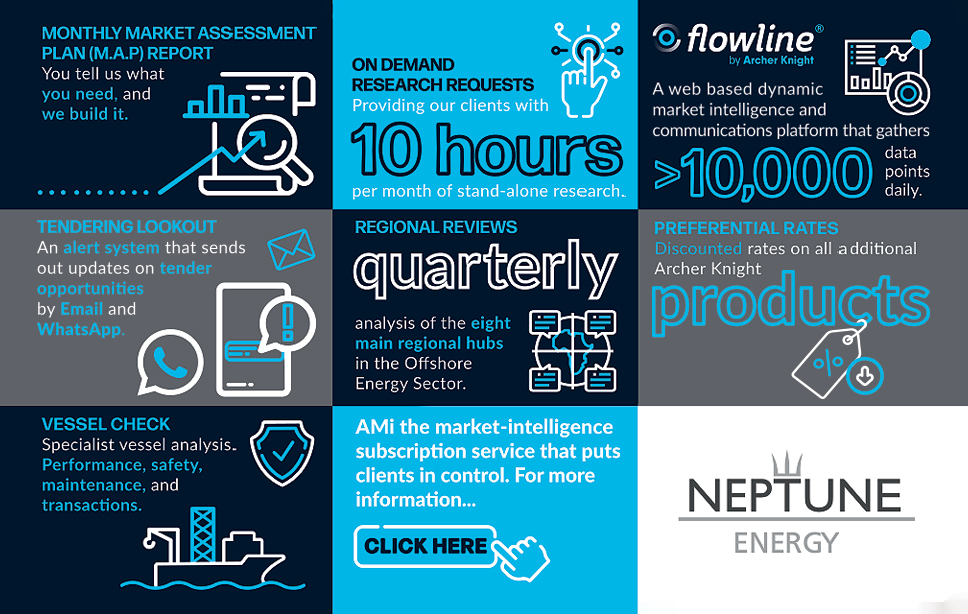

Archer Knight wins major market intelligence contract with Neptune Energy

Leading independent E&P company to use the Alliance Market Intelligence (AMi) service for its employees worldwide. Archer Knight has hailed a...

2 min read

We are delighted to announce our role as exclusive financial advisor to Aqueos on sale to Michels

Archer Knight Holdings Limited (Archer Knight), a UK-based energy advisor is delighted to announce their client, Aqueos Corporation (Aqueos), a...