Change happens fast in upstream oil & gas. Ross Macdonald looks at the four core areas we focus on to make sense of the volatility and understand the bigger picture. In part one, it’s COMPANIES.

Companies – driving industry demand

In the offshore sector, operators and stakeholders are the drivers of demand. Their appetite to grow sets the tone for whether the industry expands or retracts, so profiling and analysing their strategies and behaviour gives us a better understanding of current needs and requirements.

When there’s boom times in the oil industry, this means higher levels of spending, new projects being set in motion and expansion of the workforce.

In the current environment, with the impact of COVID-19 and the oil price drop, we’re seeing the opposite. ExxonMobil has already slashed $10 billion from its capital budget for 2020, while according to analyst assessments, exploration & production (E&P) firms have wiped $100 billion worth of investment from their books this year alone.

Similarly, job losses will be high. For example, engineering-services company Worley has announced 3,000 job cuts (5% of its global workforce). With this, comes a loss of valuable experience already in short supply in an industry that is struggling to recruit new blood as the old guard leave.

At times like these, market intelligence is arguably even more important. Businesses operating in this sector will have important questions to help them build effective engagement strategies:

-

Have companies purchasing mindsets changed – and what do they look like?

-

Are companies still able to offer the same services or have gaps in provision opened up in the market?

-

How have existing strategies been delayed and what impact does that have on the shape of future engagement?

-

How does the current environment impact the interests of the companies’ main development partners?

Cutting through the noise

Market intelligence is about making sense of your environment. For us, understanding company activity and how it overlaps and interlinks with that of projects, infrastructure and vessel activity helps us build our granular, bottom-up view of the industry and form an articulate and considered view of the market for our clients.

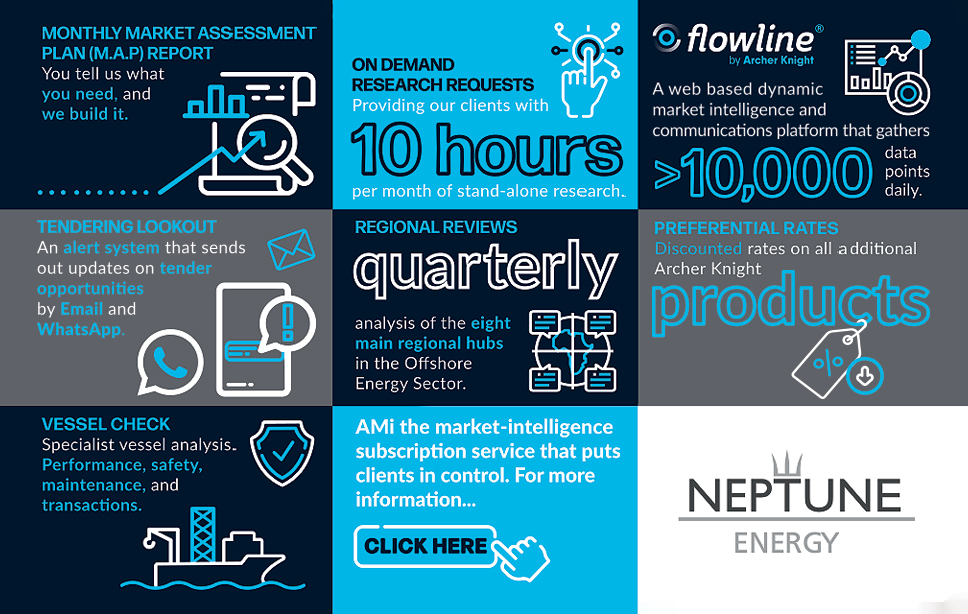

This is the central ethos behind our software-as-a-service (SaaS) platform Flowline. Launched this year, Flowline takes the mass volume of information and anchors it to these four key themes, giving its users a better understanding of offshore upstream activity in a layered and structured manner. In this way, we believe it’s possible to cut through the noise and give a clearer picture of what lies ahead.

Ross Macdonald is General Manager - Market Intelligence at Archer Knight. Contact him on rma@archerknight.com

For more information on Flowline or to book a demonstration contact flowline@archerknight.com

1 min read

4 ways to more powerful market intelligence: Part 2

Change happens fast in upstream oil & gas. Ross Macdonald looks at the four core areas we focus on to make sense of the volatility and understand the

1 min read

Announcing Flowline - Archer Knight's new subsea market intelligence software platform

Flowline – your own ‘digital employee’ We’re delighted to announce the launch of Flowline, Archer Knight’s new digital platform; an innovation to...

1 min read

Archer Knight wins major market intelligence contract with Neptune Energy

Leading independent E&P company to use the Alliance Market Intelligence (AMi) service for its employees worldwide. Archer Knight has hailed a...