Scott Mitchell on the impact of ultra-deep-water discoveries

Oil discoveries in the pre-salt layer offshore Brazil have led to a boom in Latin America’s oil production.

Read on for more analysis from Scott Mitchell on the wider impact of pre-salt discoveries for the energy sector. Or order your copy of our FPSO report for a detailed look at supply and demand in the sector between now and 2040. To order your copy email David Sheret dsh@archerknight.com

Brazil’s oil production growing rapidly

In 2020, Brazil’s production grew by 5.5% to an average of 2.94 million barrels per day. [i]The country is now the largest producer in Latin America, with output surpassing that of Mexico and Venezuela.

Petrobras, the Brazilian state oil company, maintains a formidable position in the country. However, the opening up of the Brazilian energy industry to multinationals in 1997 has led to a boom in the sector. Supermajors, including Shell, BP, Chevron and ExxonMobil are all participating in the exploration and development of Brazil’s offshore oil fields. CNOOC, China’s national oil company also holds significant interests in Brazil’s pre-salt assets.

Growth has been driven in large part by the development of offshore oil fields in the pre-salt layer of the Santos and Campos Basins, in depths of up to 2,000 metres below sea level in the south Atlantic Ocean.

Petrobras first discovered huge oil reserves at this level in 2006, and this pre-salt play has led to further investment with the promise of huge reserves.

A big role for foreign companies

To help accelerate further foreign participation in the pre-salt play, Petrobras is divesting assets, and the government has allowed private companies to participate in license rounds since 2016. Brazil’s National Petroleum Agency (ANP) has also eased the requirement for companies to use local contractors. Petrobras is aiming to sell more than 100 of its offshore fields to private and foreign companies by mid-2022.

Successful exploration programs by Brazil’s neighbors have also hastened the opening of its oil sector. In Guyana for example, ExxonMobil has made 18 offshore discoveries in the 26,800 square kilometer Stabroek block.

Brazil’s energy research agency, the EPE, has forecasted that the easing of government controls and the promotion of offshore licensing to foreign oil company participation will lead to increased investment and production.

The strategy appears to be working. The EPE now projects crude production to reach 5.2 million barrels a day by 2026. Should this come to pass, Brazil will become the world’s fourth largest crude oil producer behind the US, Russia and Saudi Arabia.

|

History of the pre-salt play |

|

Although oil discoveries had been made in the pre-salt layer as far back as the 1980s, it was not until the 2000s that declining post-salt production led to renewed exploration efforts by Petrobras. Following regulatory upheaval, pre-salt has emerged as one of the world’s foremost deep-water exploration plays. Now, it makes up around 70% of the country’s output.[ii] |

|

Oil reserves in the Santos and Campos basins are found below a 2,000-metre-thick layer of salt. Developing oil fields in these locations has proven to be a massive technical challenge – drilling through salt can cause serious wellbore integrity issues, leading to instability and collapse. Reservoir imaging is also problematic. In 2007, Petrobras created the PROSAL programme to anticipate and solve the unique problems associated with drilling and field development in the pre-salt. |

A positive knock-on effect for industry

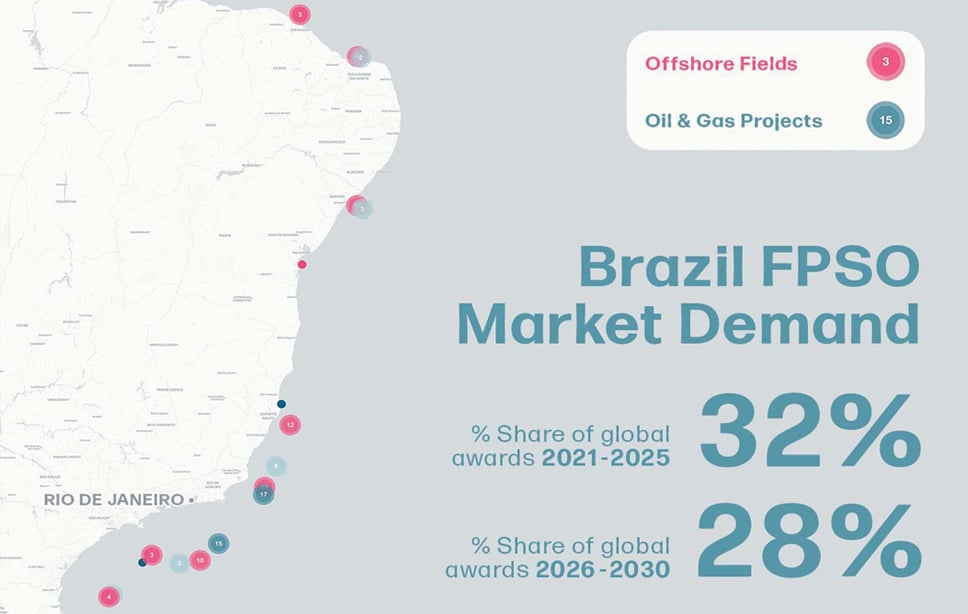

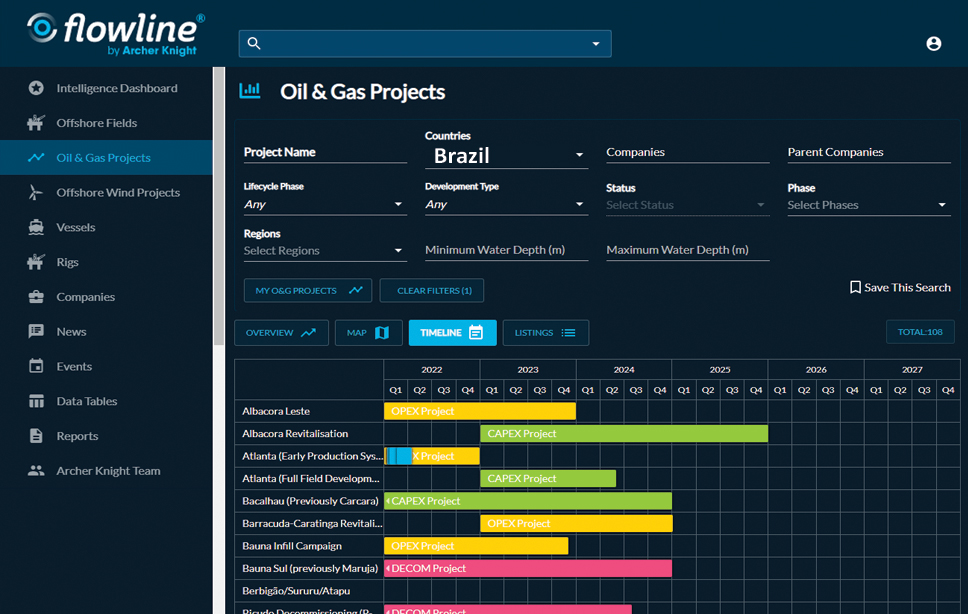

The fast-track development of Brazil’s pre-salt oil fields has led to heightened demand for FPSOs and related sub-sea equipment.

Source - AKMI Flowline® & AKMI Ltd & EMA Pte Ltd Floating Energy Report 2021

Looking at Archer Knight’s most recent Floating Energy Report*, the greatest number of FPSOawards between 2021 and 2040 will come from the South American region, with Brazil the main driver – alongside emerging nations Guyana and Suriname. Brazil is forecast to continueits lead globally and is forecast be responsible for around one third of global FPSO awards over the next decade. To order your copy of the report contact David Sheret dsh@archerknight.com

[i] ANP – Brazilian National Agency for Petroleum, Natural Gas, and Biofuels [ii] US Energy Information

*Produced in conjunction with EMA Pte Ltd for the Floating Energy Forum 2021

4 min read

Is Brazil poised to be a twin energy hub?

Renewables are taking the Latin American giant’s energy status to another level. Brazil is a major oil & gas economy, a role cemented in recent...

2 min read

David Sheret at OSJ 2020

Our Co-Founder and Executive Director was asked to speak at this year's Offshore Support Journal Conference in London in February 2020....

4 min read

Experts give their views on future of floating energy

Inaugural event helps industry leaders understand the challenges ahead Technological innovation. Learning from experience. Collaboration....