Renewables are taking the Latin American giant’s energy status to another level.

Brazil is a major oil & gas economy, a role cemented in recent years with continued exploration and production activity.

Now, as Norwegian giant Equinor looks to develop offshore wind in Brazilian waters, focus is shifting to the country’s strong potential for developing renewable technology. Already considered a global energy hub, the addition of renewables is enhancing the Brazil’s reputation.

The perfect fit for offshore wind

Brazil has one of the world’s longest stretches of coastline, at more than 4,500 miles. The waters offshore Brazil are a prime candidate for developing wind technology. According to a World Bank Group report there is 1.2 terawatt of wind-power potential from either fixed or floating turbines.

The pace of change is increasing. In August, Equinor applied to the Brazilian Institute of Environment and Renewable Natural Resources (IBAMA) for an environmental impact assessment as it looks to develop offshore wind. Reports suggest Equinor is looking to develop a 4GW project offshore Rio De Janeiro and Espírito Santo.

Brazil is the largest energy consumer in South America and much of its domestic power supply already comes from renewable sources – produced by hydroelectric dams. Offshore wind could see an increasing amount come from greener sources.

Does this mean the oil industry’s role is declining?

Despite competition from neighbours in Latin America, Brazil’s status as a major oil economy shows no sign of slowing just yet. Last year, the government said it aimed to more than double oil production to at least 7 million barrels per day.

Petrobras continues to dominate hydrocarbon production there. It produces 2.6 million barrels of oil per day from its extensive offshore network of platforms and FPSOs. However, in recent years the country has made positive strides to allow further international investment as it moves to develop ever more advance projects in deeper waters. In 2019 alone, Brazil’s government raised US$2.2 billion at auction for 12 Offshore Blocks – with Total and Petronas amongst the largest bidders.

Exploration activity is continuing at a healthy rate, even though coronavirus has put the brakes on many aspects of the industry globally, there is still evidence that growth will continue in the sector in Brazil.

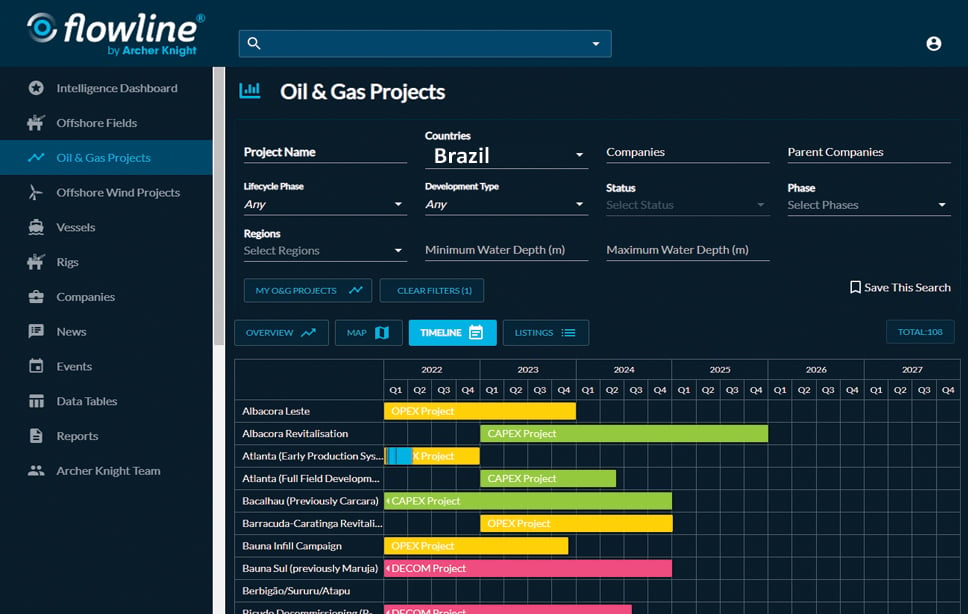

And there’s still plenty of activity to come in the next few years. Our market intelligence platform Flowline shows the sheer scale of projects both ongoing and in the pipeline, with nearly 50 projects expected at the CAPEX phase between 2020 and 2025.

Need to know more about the potential in either oil & gas or offshore wind. Our software-as-a-service platform Flowline can give you a breakdown of projects, offshore fields, companies and on a country-by-country basis. We also have detailed information on vessel activity across the world.

To find out more, or to book a demonstration on what Flowline can give your business, get in touch here

2 min read

Experts give their views on future of floating energy

Inaugural event helps industry leaders understand the challenges ahead Technological innovation. Learning from experience. Collaboration....

3 min read

How to bounce back – relationships & resilience in the supply chain

There’s no silver bullet, but the industry needs to learn lessons from previous adversity As we continue to navigate through uncharted...

1 min read

Archer Knight expands intelligence platform to embrace the offshore wind revolution

Market intelligence software now includes global floating and fixed projects. The energy industry is changing at a rapid pace, and at Archer Knight,...